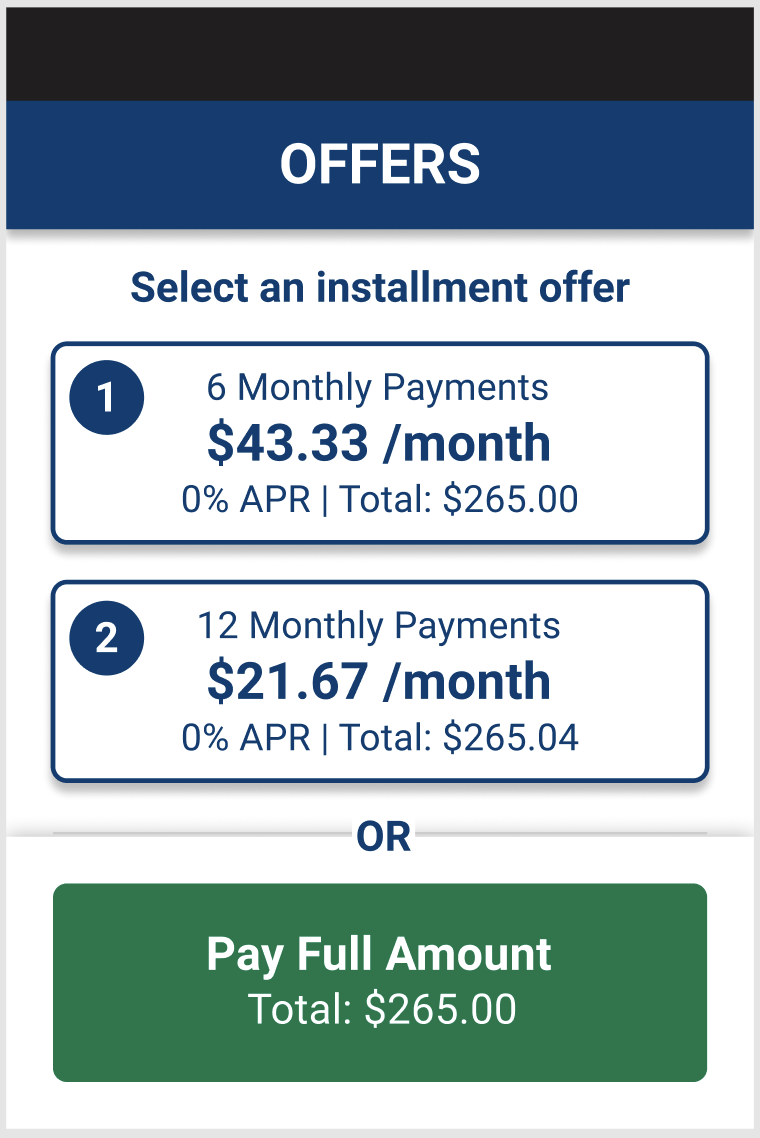

Many retail stores, especially the ones that sell luxury goods and high-value merchandise, have various financing programs or issue their own private label store cards. These programs help stores attract more customers and increase the average order value since they make the purchase more affordable for the customer. On the other hand, private label cards allow merchants to build loyalty with their customer base by offering them greater discounts by leaving funds into the store-branded cards.

Supporting these programs at the point of sale is no easy task as merchants would prefer to run all those programs through the same consolidated system so that

- it is easier for their staff to train on,

- it is always present in the same Point of Sale terminal and there are no additional systems to install

- it requires less investment into support and hardware, and finally

- it has a smaller risk of getting lost, stolen or fraud in the stores

- funds are made available through the same processor and there is no need for a new treasury setup

Moreover, Private Label cards are most desired by merchants that would like to save on interchange fees at the same establish customer loyalty. Some research has also shown that 5%-10% of the funds deposited into a store-issued Private Label card are lost or never redeemed.

For this project, we had to migrate an existing financing and private label application to a brand new platform operating on new devices that support touch-enabled screens. Migration has to account for changes in the hardware and operating system, as well as make the transition easy for an existing merchant-base of more than 12,000 retail stores.

ONTAB was responsible for the technical requirements, app architecture design, UI/UX design, user flows, migration plan, pilot rollout, data Extract, Transform and Load (ETL) migration process, project plan, development, merchant onboarding, and documentation.